Hochklassige Immobilien europaweit – eine altbewährte Geldanlage mit Zukunft.

Mit CROWDLITOKEN verschaffen wir dir Zugang zu exklusiven Immobilien in ganz Europa! Eine Geldanlage, mit der du dein Geld vermehrst. Eine Geldanlage, die stabil und sicher ist, auch in Zeiten von Krisen.

Einblick in unsere Immobilien in Oensingen und Heimberg.

- Monatliche Renditezahlung

- Sicher und stabil, auch in Krisenzeiten

- Einfach und digital dein eigenes Portfolio zusammenstellen

Lage

Die Immobilie liegt im schönen Oensingen, Schweiz. Aus Datenschutzgründen veröffentlichen wir hier nicht die genaue Adresse. Als Investor erhältst du jedoch die detaillierten Angaben zu dieser Immobilie und noch viel mehr.

Unsere Immobilien

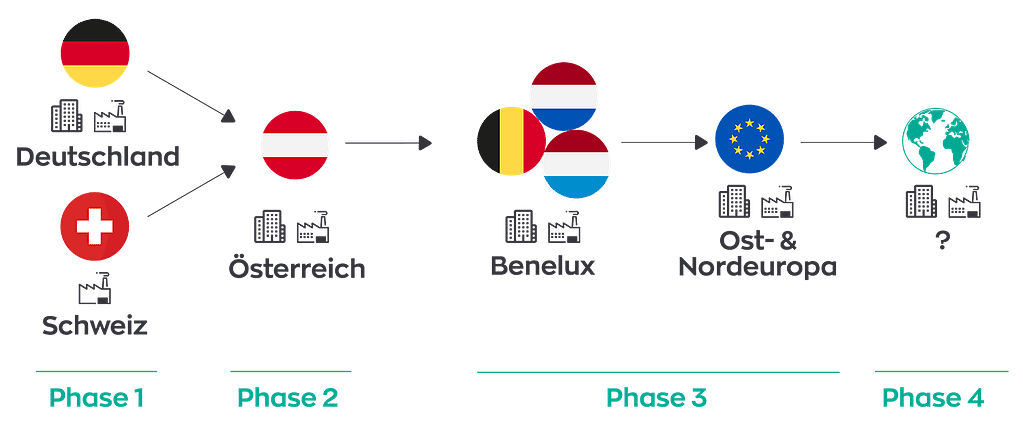

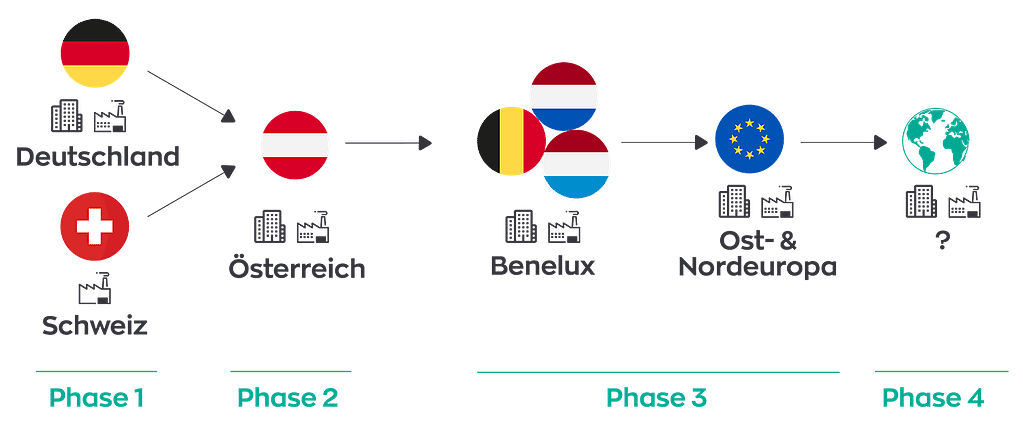

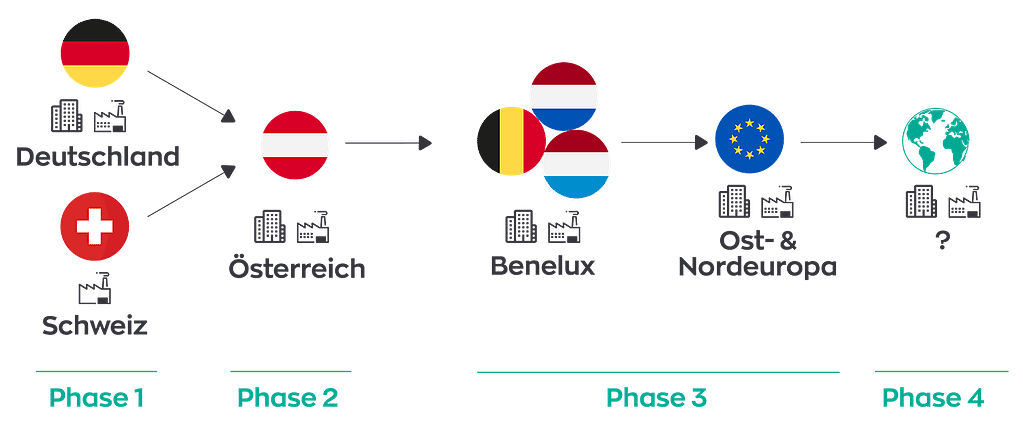

CROWDLITOKEN investiert dein Geld in den Kauf von Wohn- und Gewerbeimmobilien in ganz Europa. Grundlage dafür ist unsere Immobilienstrategie. In der ersten Phase wird in Liegenschaften aus der Schweiz und Deutschland investiert, um sofort Stabilität für unsere Investoren zu schaffen.

Länderstrategie

Die CROWDLITOKEN AG wird in mehreren Ländern der Schweiz und der Europäischen Union Grundstücke und Immobilien erwerben. Ausgangspunkt für den Portfolioaufbau sind die Schweiz und Deutschland.

Die länderspezifischen Kriterien für den Aufbau des Portfolios und den damit verbundenen Kauf von Liegenschaften definiert die Immobilienkommission. Ziel ist es, ein qualitativ stabiles Portfolio aufzubauen, welches werterhaltend ist und Chancen für einen Wertezuwachs hat.

Immobilien als Geldanlage

Von direktem Immobilienkauf, über Immobilienaktien bis hin zu Crowdinvesting gibt es verschiedenste Möglichkeiten für verschiedene Bedürfnisse. Besuche unser Investment-Wiki und lerne mehr über Immobilien und Geldanlagen.

Immobilienstrategie

Immobilien-strategie

Die Immobilienstrategie ist ein übergeordnetes Dokument, welches durch die Immobilienkommission erarbeitet und vom Verwaltungsrat der CROWDLITOKEN AG genehmigt wurde.

Die Immobilienstrategie ist ein ergänzendes Dokument zum Produktbeschrieb und dem durch die Finanzmarktaufsicht (FMA) gebilligten Vertriebsprospekt. Hier findest du alle Informationen zu Immobilien, die CROWDLITOKEN kaufen wird.

Unsere Investoren profitieren von

- Optimierten Erträgen

- Einer breiten Auswahl an Immobilien europaweit

- Vollständiger Transparenz von Kosten

- Mitbestimmungsrecht beim Verkauf bestehender Liegenschaften

Immobilie Ankauf

Du hast eine Immobilie, die unseren Anforderungen entspricht?

Wir nehmen dein Angebot sehr gerne entgegen. Fülle das Formular aus und wir nehmen mit dir Kontakt auf.