Your real estate savings plan – the smart alternative to a savings account

Achieve your personal savings goal or plan your retirement by simply setting up a standing order and regularly investing the amount of your choice in real estate. No negative interest as with the bank, but currently up to 5.5% return per year!

Your advantages at a glance

You choose the amount (from 100 CHF / EUR)

Set up your individual real estate savings plan and decide for yourself how much money you want to invest monthly. Minimum investment per month: 100 CHF/EUR.

You determine the payment interval

You only want to buy new tokens every second month? No problem – by setting up a standing order with your bank, you can decide for yourself at what intervals you want to deposit money.

You benefit from the compound interest effect

Earn interest on your interest! With the CRT savings plan, your invested capital grows faster, as you can immediately reinvest your distributed return in the form of new tokens.

You can cancel the standing order at any time

You decide what happens with your money! Adjust your standing order at any time or simply cancel it. Whether after one month or after 10 years. The decision is entirely up to you.

Calculate your savings potential

Use our calculator to see how your saved money will increase within the given time if you invest it in CROWDLITOKEN.

Your Investment

How many years do you want to save?

Years

What would the monthly savings amount be?

CHF / EUR

How much would your first investment be?

CHF / EUR

Your Result

Your invested CHF / EUR becomes CHF / EUR

Interest rates used for calculations: 5.5% CROWDLITOKEN, 1% bonds, 0% savings account.

This is what you benefit from at CROWDLITOKEN

Gain access to safe and efficient properties across Europe with CROWDLITOKEN.

Digital bond

Low minimum investment, open for CHF and EUR, easy to handle.

Returns of 5-7% p.a.

Build your own property portfolio by simply placing bonds on available properties and benefit from returns of up to 7% per year.

Real value thanks to real estate

Inflation-protected bondwith up to 7%yieldper year. Hand-picked core properties in Europe provide stable growth and solid returns. .

Minimum interest rate

Your investment with CROWDLITOKEN secures you a minimum return of 0.875% p.a.

No administration costs

Everything digital, without the hassle of paperwork.

Tradeable at any time

Handle your bonds easily at any time.

Why you should invest

your money in CROWDLITOKEN

High returns and security

Before we list projects on our platform, they are thoroughly assessed. The success and security of your investments is our success.

Short-term results

With CROWDLITOKEN you don’t have to wait years or decades to see the returns on your investment. It’s the perfect way to generate a passive income.

Total control, total transparency

All data and facts about each property are made available to our investors in a clear and comprehensive manner.

Testimonials

I always want to win - I hate to lose. As an investor in CROWDLITOKEN, I am certainly one of the winners. I appreciate the advantages that are offered to me here. With great conviction, I have already invested.

The future of real estate investment will take place via blockchain. CROWDLITOKEN is an innovator and was one of the first companies to manage to combine technology and concrete gold! No incomprehensible business models, but hard assets that everyone understands.

CROWDLITOKEN is one of the first providers of low-cost, uncomplicated and, thanks to the real estate, secure investment opportunities with a tidy return. In addition, there is the option to use the compound interest effect. You will hardly find a better investment!

CROWDLITOKEN enables even small investors to invest in attractive real estate and makes the market accessible to everyone. The business model stands for a new generation of digital financial products - sophisticated and likeable.

I deal with real estate on a daily basis and therefore know what sustainable values good properties offer. I trust CROWDLITOKEN's expertise to keep my savings safe and profitable.

I work with securities on a daily basis and follow market events with great interest. CROWDLITOKEN is the best investment opportunity for me personally. My money is invested safely and flexibly here, and I can also look forward to nice returns.

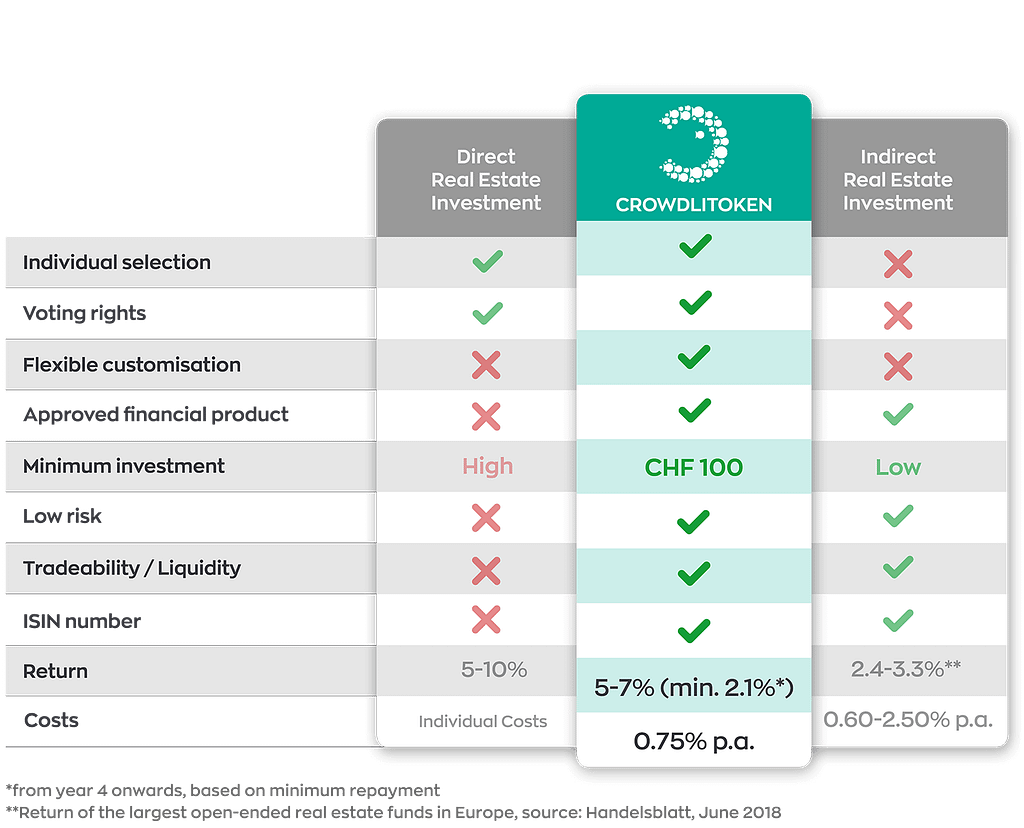

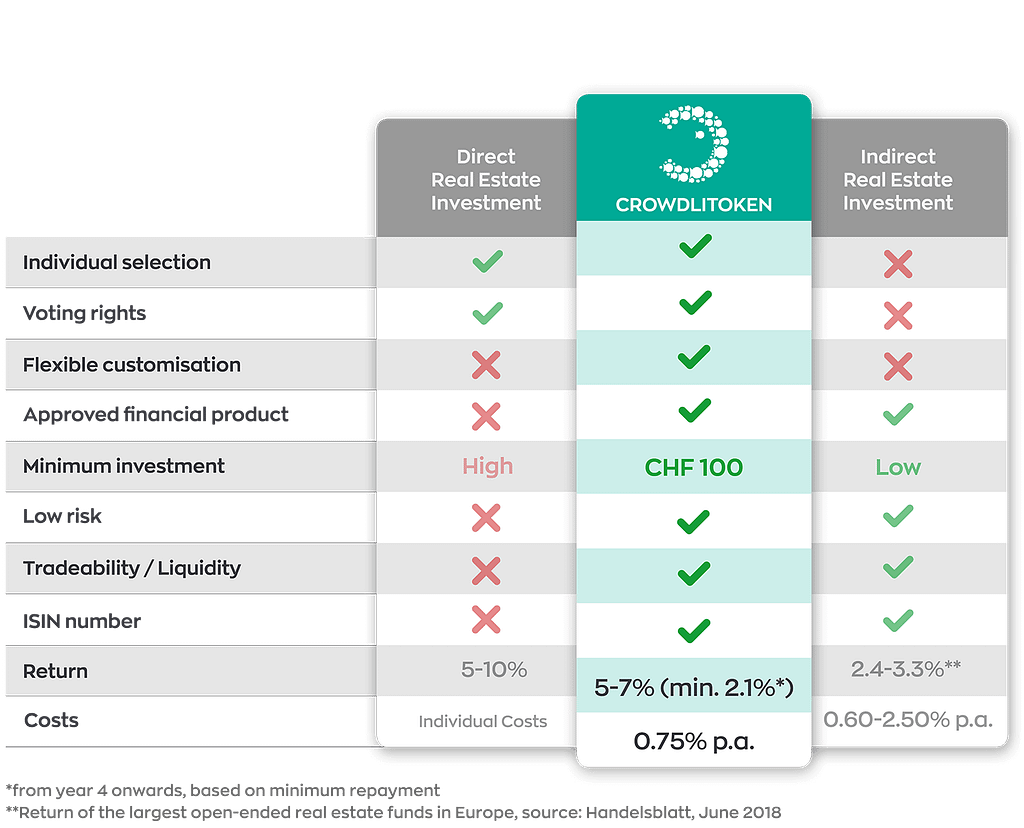

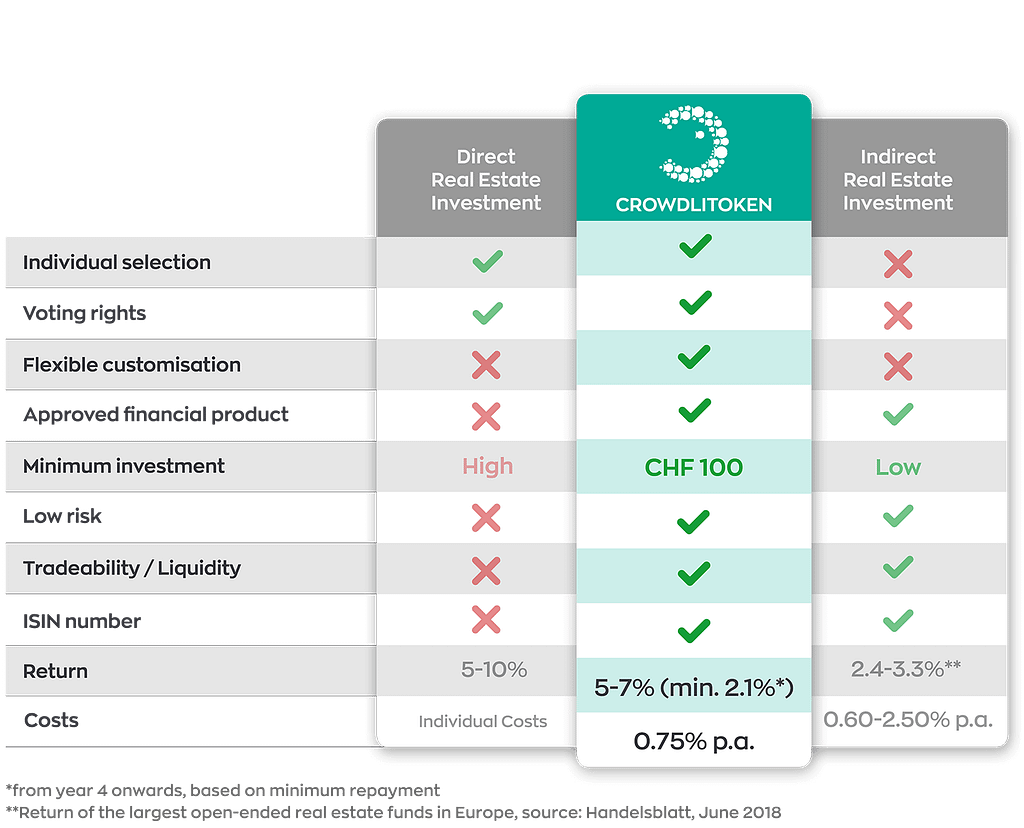

The difference between CROWDLITOKEN and other real estate investments

The difference between CROWDLITOKEN and other real estate investments

CROWDLITOKEN enables anyone to invest in top properties and benefit from the opportunities of the real estate market in an accessible and fully digital way. Our team of experts makes investing in hand-picked properties accessible to everyone by applying state-of-the-art technology.

CRT is the first Ssecurity tokenthatunitesthe advantages of direct and indirect real estate investmentsin one product:

- Elimination of inefficiencies

- Reduce costs

- Complete transparency

Frequently asked questions (FAQ)

Is something unclear? We have the answers to your questions.

Any questions?